CASE STUDY

Transforming Reinsurance with a Blockchain-Driven Marketplace: A UX and Design Innovation Case Study.

Introduction

This case study showcases the successful design and development of a blockchain-driven digital marketplace for a reinsurance startup. The reinsurance industry specifically focuses on Seaboard hurricane-based contracts at the hundreds of millions of dollars in contract valuation. Historically, the reinsurance industry has been primarily a paper-driven agreement system. The disruption opportunity for Tremor was an open field.

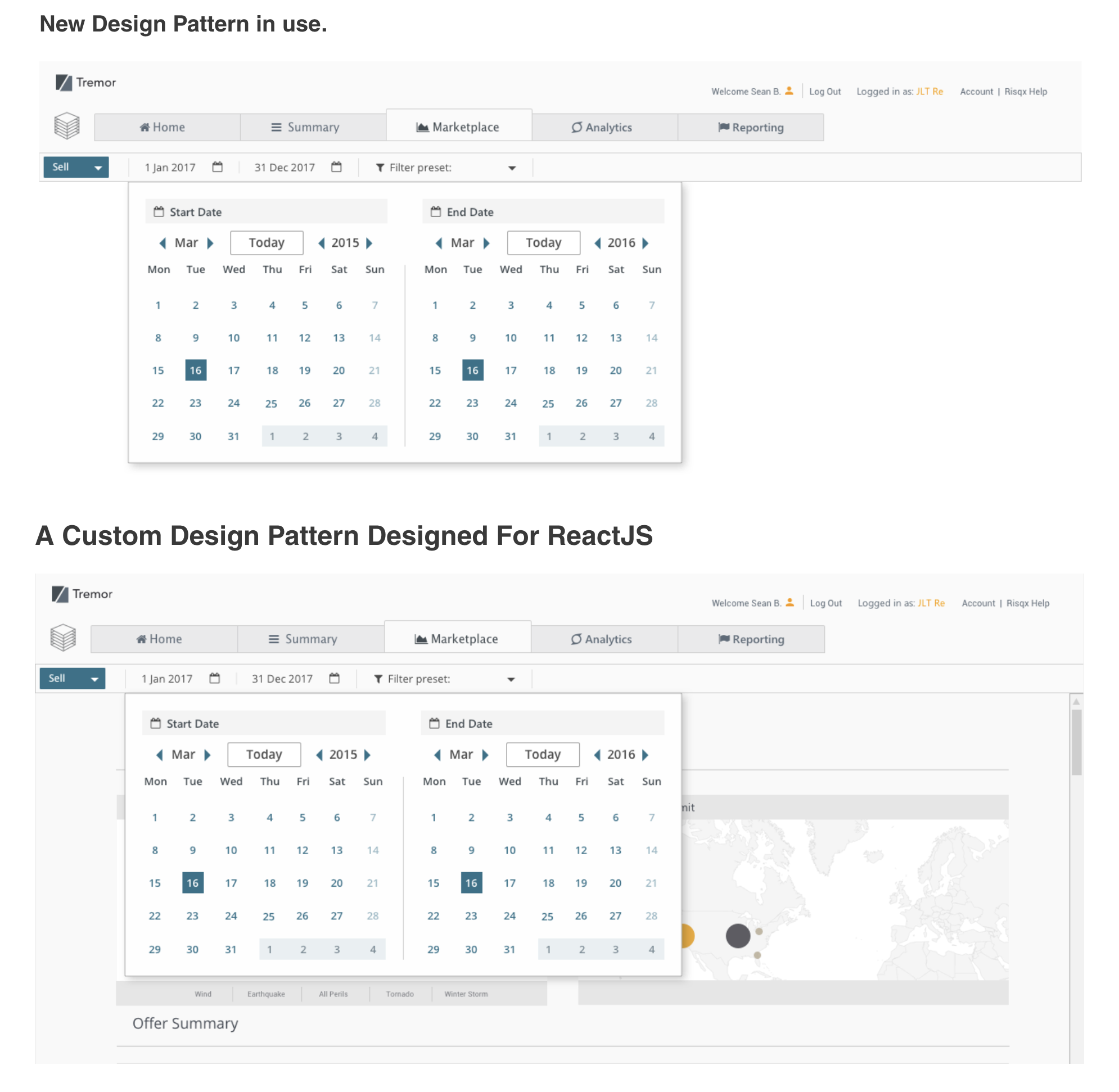

Faced with usability challenges, including complex filtering processes and an inefficient calendar system, we created innovative ReactJS design patterns to simplify user interactions. By implementing a scalable two-step filter, customizable dashboards, and enhanced visual aesthetics, we transformed the platform into a seamless, user-friendly experience. The new marketplace now offers features like live blockchain trading tickers, personalized widget libraries, and real-time weather forecasts, accelerating decision-making and improving user engagement across the reinsurance industry.

Client: Tremor Inc.

Position: Lead UX Design and Research

The Problem

A disruptive startup in the reinsurance industry needed to build a blockchain-driven digital marketplace from scratch.

A disruptive startup in the reinsurance industry needed to build a blockchain-driven digital marketplace from scratch. The existing design patterns were cumbersome, requiring users to input complex filtering options multiple times a day, leading to a poor user experience. Additionally, the calendar system for defining dates and ranges was inefficient and not aligned with the user’s needs for quick access to reinsurance data.

Hurricane Ian (2022): This was one of the costliest natural disasters, causing between $54 billion and $56 billion in insured losses. It largely affected the U.S. Gulf Coast, including Florida. It ranks as the second-highest insured loss from a hurricane on record.

(S&P Global\)(Swiss Re)

The Method

We developed new design patterns to optimize usability and streamline data aggregation, focusing on:

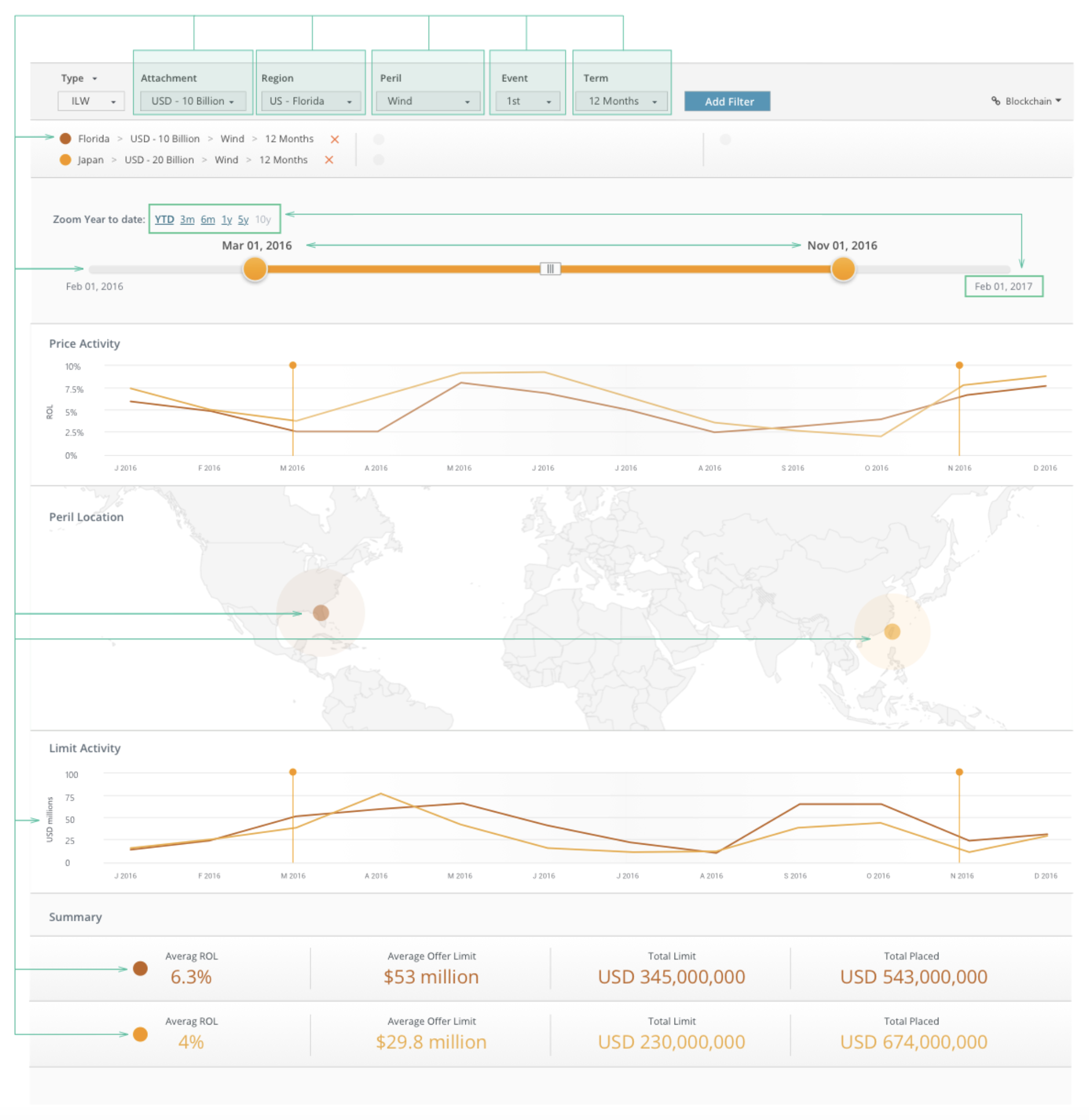

Filters and Search: Designed a two-step, scalable filter accessible from the main header bar called the "Superball" or Coverage Filter Control. This filter simplifies access to Industry Loss Warranty (ILW) coverage contracts with customizable data sets and multiple combinations.

Custom Dashboards and Analytics: Implemented a customizable, color-coded dashboard that allows users to compare reinsurance data (e.g., comparing Florida vs. Japan contracts) with summary statistics bars that update dynamically based on filter selections.

Aesthetic Enhancements: Redesigned the user interface using a nature-inspired color palette to convey trust and ease, transforming the calendar component into an aesthetically appealing and functional tool.

Hurricane Ida (2021): Ida inflicted approximately $30–$32 billion in insured damages, making it one of the most significant reinsurance events in the last five years. This hurricane, particularly devastating for Louisiana and other coastal states, also caused severe flooding as far north as New York

(Swiss Re)

The Solution

The result was a seamless marketplace platform with enhanced usability and scalability, featuring:

New ReactJS Design Patterns: Created a customizable widget library and responsive design for tablets, empowering users to personalize their experience.

Improved Filters: The two-step "Superball" filter simplifies complex contract comparisons and is scalable for future coverage types.

Live Features: Integrated a live blockchain trading ticker for real-time contract pricing and an on-demand weather forecast to assist decision-making for insurance providers and purchasers.

Overview

Tremor is a risk transfer marketplace with an algorithmic matching engine to facilitate trading between reinsurers and cedents. Tremor offers various analytical tools for portfolio and individual-level transactions including pricing benchmarking. Tremor also has an issuance platform for insurance-linked warranties, retrocession treaties and catastrophe bonds as well as a short placement tool.

Winter Storm Uri (2021): Though not a coastal hurricane, Uri significantly impacted coastal areas, particularly in Texas, with around $15 billion in insured losses due to extreme cold and power grid failures

(Swiss Re)(S&P Global)

Lab activity

Primary way aimed to improve insurance processes and tools whilst in the Accelerator: Risk marketplace

The product that Tremor developed with input from the mentors and other participants of the Lab saves the insurance buyer 10-20% on price and cuts down placement time for complex facultative and treaty placements by three times.

“Usability is about people and how they understand and use things, not about technology.”

- Steve Krug